Solana Trades Up 15.7%, But Network Issues Raise Concerns

Solana (SOL) traded 15.7% up and lead gains earlier as the crypto market started to see the green zone, recovering from the total cap value dropping to $2,1 trillion, now at $2,2 trillion, a 5% increase in 24 hours.

As several altcoins from the top 100 savor the upswing, it’s a polarized day for Solana’s popularity as the network saw major congestion issues that might put down price expectations for 2022.

A few days ago SOL saw a two-month low of around $150, but losses are in reverse in the past 24 hours. The digital coin went up as much as $188, a 15.7% daily growth. Solana’s market cap value grew from $51.17 billion to $56.76 billion during the period (adding $5.59 billion).

In terms of competition for the top 5 cryptocurrencies by market cap, Solana took the win while Ethereum surged around 4%. Cardano climbed 3% and Avalanche, on the other hand, is also seeing growth surging 15% in 24 hours after announcing native support for USD Coin (USDC), swinging up above the $100 mark.

Solana, The Cool Kid On The Block ?

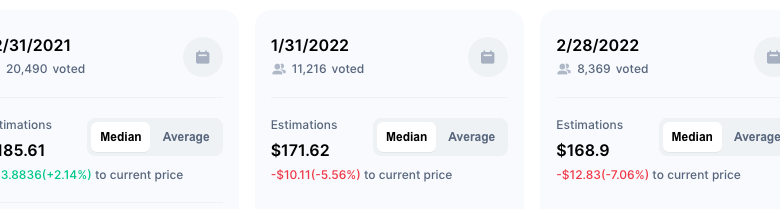

As Solana grows in popularity surrounded by mainstream projects, crypto users at CoinMarketCap shared positive estimates of the median price for the end of the year: 20,490 people think SOL will be closing the year trading around $185. However, the community is predicting a downside starting 2022 to $171, then lower to $168 by the end of February. What are they seeing?

Solana has more troubled moments to mention. The first one was back in September with a 17-hour network outage. Then, during this month alone, on December 9th the network reportedly suffered a distributed denial-of-service (DDoS) attack which also resulted in delayed transactions.

Clarity wasn’t the top priority at the time. The first tweet to mention the DDoS attack was deleted, then the infrastructure firm GenesysGo reported the issue but claimed it was due to “growing pains”. And on December 13th, a Solana-based NFT debut (SolChicks) announced that “CHICKS HAVE TAKEN DOWN SOLANA.”:

We apologize for the inconvenience of this delay but tens of thousands of people are trying to buy $CHICKS and the Raydium server has crashed. It appears SolScan is also not loading our contract address right now either.

However, Solana’s price has not seen investors fear since the last failure of transactions happened –at least not beyond the low prediction from the CoinMarketCap community. Is the hype stronger than the issues?

The rise of Solana has seen big investors as backers (like Sam Bankman-Fried, Andreessen Horowitz, and Polychain) and a large number of projects with big names, especially in the gaming and NFT sectors. If the blockchain’s transactions are not fast enough sometimes, their marketing is.

For example, basketball giant Michael Jordan just announced a platform for athletes called HEIR, which is based on Solana. This mainstream event was believed to carry SOL’s price up. Will popularity be enough for the future of the blockchain?