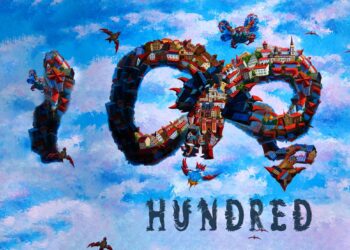

Greater than the Sum of its Parts: Hundred Finance Combines Multiple Innovations in a Multi-chain Project

As the blockchain industry continues to attract the attention of a greater number of users, businesses, institutional investors, and even governments than ever before, the need for decentralized applications able to appeal to a general audience is now larger than ever. In fact, such is the success of blockchain, that the number of platforms, or chains, that make use of its technology is increasing at a staggering rate. The development of this multi-chain ecosystem has created a market for projects that embrace interoperability and see an opportunity in matching the financial growth of the industry with a growth in the adoption of innovations that can make its applications available and affordable to all.

The growth trajectory of blockchain technology has brought its communities, many of which have long been fiercely loyal to their own chosen tech stack, to a crossroads. The sheer number of projects innovating, as well as the explosion in investors, means that new breakthroughs in tokenomics and token governance are occurring regularly. Scaling solutions, liquidity locking, DAO infrastructure, have all proven their worth to established dApps, yet incorporating these advances in any one product is less common than one might imagine. Projects taking an explicitly multi-chain and incorporative approach are few and far between, and solutions that are explicit in their intention to bridge chains and communities, thereby promoting a more seamless growth in the industry, are so far lacking. There is hope, however.

Hundred Finance Leads the Way in Multi-chain Adoption

Hundred Finance is a decentralized application (dApp) created to allow the lending and borrowing of cryptocurrencies. Launched on Ethereum’s Kovan testnet in June of 2021, it seeks to create a lending ecosystem that unites the communities of the growing list of Ethereum Virtual Machine (EVM)-compatible blockchains and scaling solutions in a multi-chain ecosystem.

As the name suggests, a multi-chain ecosystem can be defined as the state in which several blockchains co-exist and, in some cases, are interconnected. If cross-chain bridges exist, connections allow tokens to be transacted across chains and projects to be deployed on multiple chains at once. One great advantage of a multi-chain approach is that it creates permissioned environments that suit the preferences of different user groups. For example, those that wish to maintain the utmost security for the majority of their assets may use a base layer for this purpose, deploying only a small portion of their funds to other chains. In turn, this market makes it easy for enterprises to create chains for their assets, dictate transactions, variables and types without creating a barrier from use.

Currently, the Hundred Finance protocol is implemented on three popular chains. These include the Ethereum mainnet, the Arbitrum Layer 2 scaling solution, and the Fantom Opera blockchain network. Users gain access to these networks through the Hundred Finance dApp’s integration with compatible Web3 wallets. This means that end-users can select the network they wish to interact with from the platform’s main page in the same manner independent of the chain that they’re using (though assets, interest rates, and other variables such as transaction costs may differ between them).

In addition to its multi-chain outlook, Hundred Finance is an open-source project and adopts the best of open source technology in order to offer maximum functionality while ensuring that security remains paramount. It uses different features and products to help drive its mission, at the heart of which is the HND token. The HND token was created to serve as an incentive mechanism and governance device available wherever the dApp is deployed.

The project is soon to incorporate technology first created by Curve Finance to create incentives to hold the HND token, while simultaneously laying the groundwork for its advanced governance system. This is being aided through the use of SharedTools, an open-source initiative that assists projects in sharing code and technology. These combined efforts will provide the foundation for the subsequent implementation of first-of-their-kind platform innovations that include multi-chain governance and mechanisms for allowing the collateralization of assets across chains. While these initiatives are still in their research phase, they are planned to provide unique value propositions to Hundred Finance, value propositions that prove that in a multi-chain ecosystem a project can certainly be greater than the sum of its parts.